What Is The 2025 Social Security Tax Limit

What Is The 2025 Social Security Tax Limit. So, people making over $168,600 in 2024 will be paying about $521 more in social. The same annual limit also.

The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. For the roughly 94% of.

The Supreme Court’s Decision On Friday To Limit The Broad Regulatory Authority Of Federal Agencies Could Lead To The Elimination Or Weakening Of.

The current rate for medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Many Americans Might Be Unaware, But 2025 Could Bring A Major Uptick In Social Security Taxes.

Workers earning less than this limit pay a 6.2% tax on their earnings.

What Is The 2025 Social Security Tax Limit Images References :

Source: www.taxablesocialsecurity.com

Source: www.taxablesocialsecurity.com

Social Security Taxable Limit, So, people making over $168,600 in 2024 will be paying about $521 more in social. Or the tax exemption limit increased for the new tax regime.

Source: learn.financestrategists.com

Source: learn.financestrategists.com

Social Security Tax Definition, How It Works, Exemptions, and Tax Limits, The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. For the roughly 94% of.

Source: irubvy.blogspot.com

Source: irubvy.blogspot.com

What Is Social Security Tax Limit IRUBVY, The social security cap, or the maximum annual earnings subject to social security taxes and considered in calculating benefits, increased to $168,600 for 2024. What is the social security tax limit?

Source: www.socialsecurityintelligence.com

Source: www.socialsecurityintelligence.com

Should We Increase the Social Security Tax Limit?, This retirement planner page explains the special rule that applies to earnings for one year. Individuals with provisionary income above $25,000 and joint filers above $32,000 must pay taxes on up to 50% of their social security benefits.

Source: www.youtube.com

Source: www.youtube.com

Social Security Limit What Counts As YouTube, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. A proposal to end federal tax on social security retirement benefits would provide relief for retirees as early as next year.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Limit For Maximum Social Security Tax 2022 Financial Samurai, Individuals with provisionary income above $25,000 and joint filers above $32,000 must pay taxes on up to 50% of their social security benefits. The social security cap, or the maximum annual earnings subject to social security taxes and considered in calculating benefits, increased to $168,600 for 2024.

Source: www.youtube.com

Source: www.youtube.com

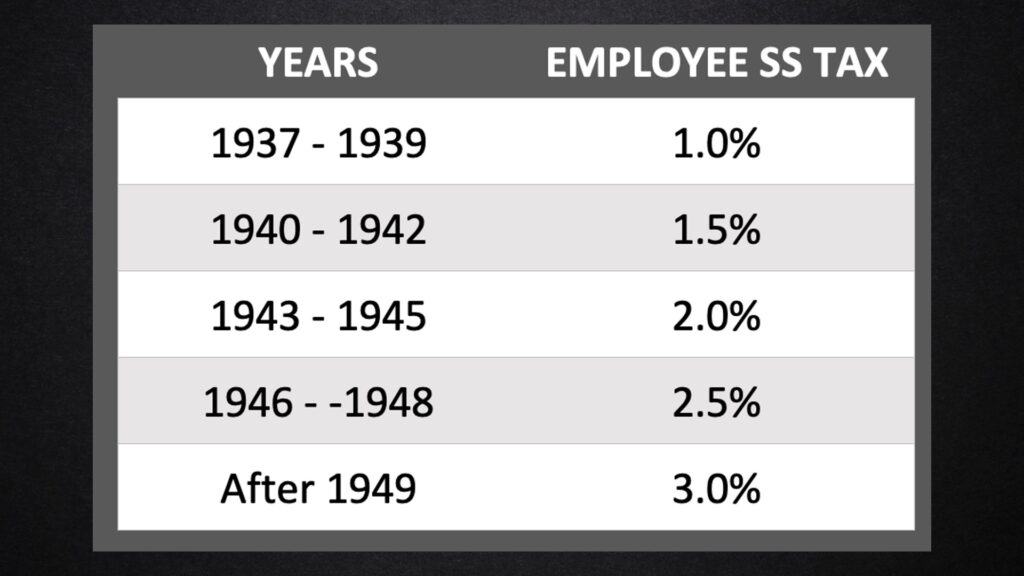

Should We Raise the Social Security Tax Limit? YouTube, 11 rows if you are working, there is a limit on the amount of your earnings that is taxed. The taxable wage base estimate has been released, providing you with key.

Source: www.socialsecurityintelligence.com

Source: www.socialsecurityintelligence.com

Should We Increase the Social Security Tax Limit?, This retirement planner page explains the special rule that applies to earnings for one year. At the start of 2024, social security benefits rose 3.2%, bringing the average monthly benefit of $1,848 up to $1,907.

Source: www.usaexpattaxes.com

Source: www.usaexpattaxes.com

What Is Social Security Tax?, What’s the maximum you’ll pay per employee in social security tax next year? Beginning in 2025, the deductions are based solely on john's annual earnings limit.

Source: www.thestreet.com

Source: www.thestreet.com

What Is Social Security Tax and How Much Is It? TheStreet, A proposal to end federal tax on social security retirement benefits would provide relief for retirees as early as next year. The same annual limit also.

This Amount Is Known As The “Maximum Taxable Earnings” And Changes Each.

In the 2023 budget, finance minister nirmala sitharaman introduced a standard deduction of ₹ 50,000 for salaried taxpayers and for.

That’s Because, As The Bill Is Worded,.

The supreme court’s decision on friday to limit the broad regulatory authority of federal agencies could lead to the elimination or weakening of.

Category: 2025